Finance and Politics | Dec 16, 2024

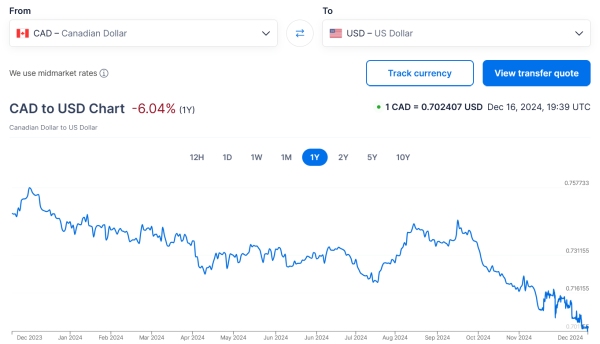

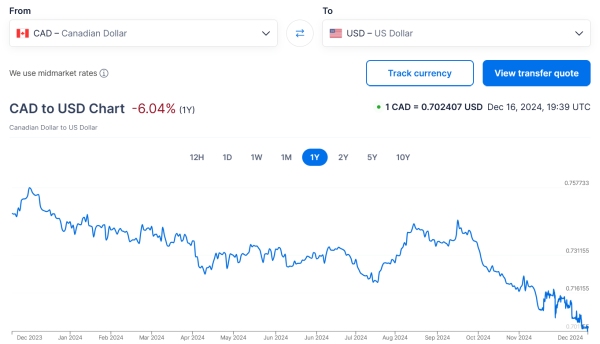

Image: CAD-USD forex rate (XE.com, Dec 16, 2024)

Chrystia Freeland Resigns, U.S. Tariffs, Weak Dollar, and Rising Debt Highlight Canada’s Tough Economic Choices

On December 16, 2024, Chrystia Freeland resigned as Canada’s Finance Minister and Deputy Prime Minister. Reports indicate that Prime Minister Justin Trudeau asked Freeland to step down. Her resignation letter (see below) suggests major policy disagreements over the government’s fiscal direction and its response to mounting economic pressures such as the the government’s growing deficient, a weakening Canadian dollar, and Trump’s threat of 25% U.S. tariffs across the board. Her sudden exit amidst a crumbling Liberal party is a public warning.

See my letter to the Prime Minister below // Veuillez trouver ma lettre au Premier ministre ci-dessous pic.twitter.com/NMMMcXUh7A

— Chrystia Freeland (@cafreeland) December 16, 2024

Key Highlights from the Fall Economic Statement

The release of Ottawa’s Fall Economic Statement (FES) came just a few days before Chrystia Freeland announced her resignation which is unprecedented and highlights serious economic challenges facing the country. Canada’s debt to GDP ratio has climbed to 43.2%, which is above the pre-pandemic level of 31.2%, causing concern about financial stability. While the FES is designed to boost tech and innovation to drive economic growth while addressing fiscal challenges, it comes with an expensive price tag with the 2024 deficit expecting to be more than $40 billion, up from earlier projections of $35 billion.

See: Reversing Canada’s Digital Economy Productivity Decline

There are a number of changes announced in FES that could impact the fintech sector and help foster innovation, streamline regulatory alignment and encourage capital flows. Key measures include $26 billion in tax incentives, expanded venture capital funding, and reforms to enhance investment opportunities in Canada.

The government announced changes to the Scientific Research and Experimental Development (SR&ED) tax program. These changes include raising the annual limit for enhanced tax credits from $3 million to $4.5 million and increasing thresholds for eligibility to encourage more businesses to invest in research and innovation. The program will now also allow public corporations to qualify, and capital expenses will again count toward credits.

The government removed the 30% rule that limits how much Canadian pension funds can own in a single company. This change was made to encourage pension funds to invest more in Canadian businesses.

A new $1 billion round of the Venture Capital Catalyst Initiative (VCCI) to provide more support for early-stage companies (with better terms to attract investments from pension funds and other large investors).

The government also plans to invest up to $45 billion in loans and equity to support AI data centers and other projects where Canadian pension funds are key players. These measures are meant to grow AI expertise in Canada and support infrastructure projects to boost job creation.

Critics argue that the 2024 Fall Economic Statement’s increased spending could worsen Canada’s fiscal challenges.

U.S. Tariff Threat and the Canadian Dollar

Adding to Canada’s domestic concerns is Trump’s plan to impose a 25% tariff on Canadian imports. The University of Western’s Ivey Business School reported that even a 10% tariff could reduce Canada’s GDP by approximately 2.4 percentage points over two years, putting around 500,000 jobs at risk.

A report by Trevor Tombe, Professor of Economics at the University of Calgary, suggests that a 10% tariff could reduce Canada’s productivity another 1% and result in approximately $30 billion per year in economic costs.

See: Canada’s Innovation Paradox – Strong Start, Missing Impact

All of this has put a lot of downward pressure on the Canadian dollar which has declined to around $0.7 CAD-USD which makes imports like food, fuel and electronics more expensive. It’s the combination of rising costs and trade/geopolitical uncertainty that is straining household budgets and creating challenges for companies doing cross-border trade and international business.

Snap Election?

Freeland’s departure has intensified political instability within the Trudeau government. Trudeau may call an election to reset his political agenda but the move could backfire if the Conservatives capitalize on growing dissatisfaction. There’s a growing laundry list of folks demanding that Trudeau resign.

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org